Investing in companies that share your values may seem like a novel concept in an industry that’s historically been all about the bottom line, but this is changing quickly. As the tumultuous events of 2020 amplified conversations the world over about climate change and social justice, investors quickly turned their attention to the role of corporations in shaping the future of our world.

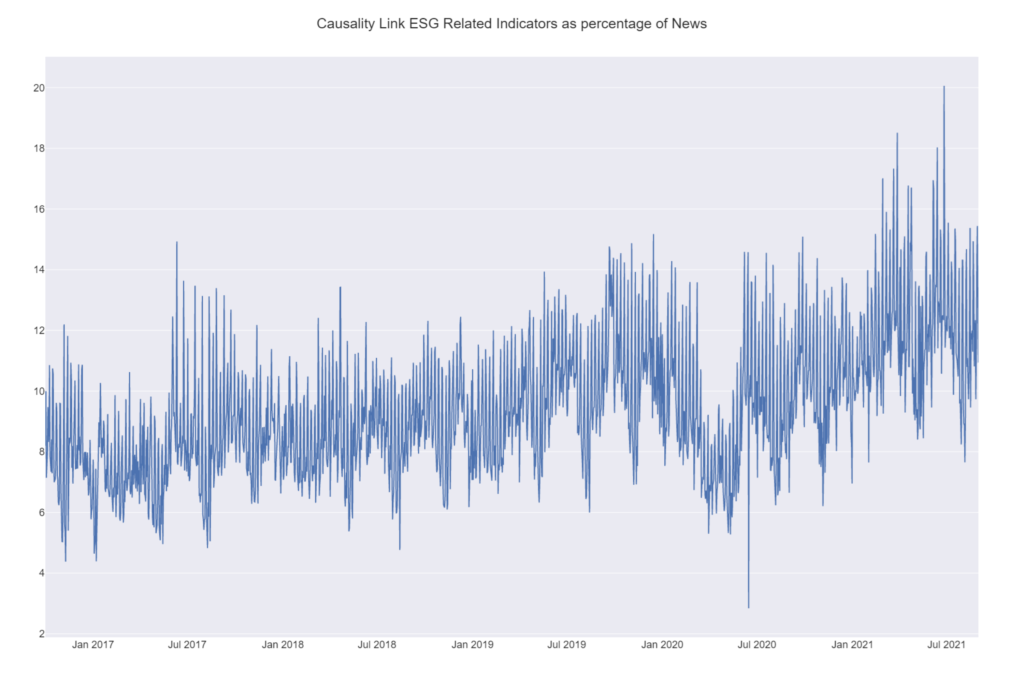

Environmental, social and governance (ESG) investing — a sustainable investment strategy that specifically considers those factors — has proven itself to be far more than a passing fad, transforming from a niche practice to a rapidly expanding sector. According to data obtained from Causality Link — a provider of AI-and NLP-derived financial intelligence, including ESG metrics — media attention on ESG-related topics, which had been in decline at the outset of the pandemic, hit a new high in late June 2021, peaking at just over 20% of all media coverage and resulting in a surge in demand for investment vehicles that promote these causes.

There are now ESG investment opportunities in a wide range of asset classes, with a full array of ETFs, bonds and derivatives now available for trading. With global ESG assets projected to exceed $53 trillion by 2025 — which is more than a third of the $140.5 trillion in projected total assets under management, according to Bloomberg Intelligence — it’s clear that individual shareholders and institutions alike are getting serious about sustainability.

But the unprecedented growth of the space also comes with growing regulatory scrutiny. As firms across the capital markets work to keep up with demands from retail and institutional investors, there is mounting concern from global regulators and lawmakers that some ESG investment products might not be as green as they appear.

As ESG investing cements itself as an industry priority and a fundamental part of the investment process, firms are working to ensure they have a role to play in its future. But how can these players ensure their ability to navigate this increasingly complex environment while serving investors who want to make both money and an impact in equal measure? ESG investing experts have a few ideas.

From Fringe to Front and Center

2020 may have seen the popularity of ESG investing skyrocket, but the general concept started to gain traction with institutional investors decades before the pandemic took hold last year. Socially responsible investing (SRI), widely considered the predecessor to ESG, steadily gained prominence throughout the second half of the 20th century. SRI involves screening companies based primarily on an individual investor’s moral positioning and related criteria.

While useful for some investors, SRI gained a reputation for sacrificing returns based on arbitrary decisions. Years later, ESG, which considers a more holistic, long-term view to identify relevant companies with higher investment potential, has proven that investing sustainably does not have to come at the cost of performance. A study from Morgan Stanley’s Institute for Sustainable Investing found that sustainable funds have outperformed traditional peer funds and reduced investment risk during the COVID-19 pandemic.

While both SRI and ESG fall under the umbrella of what is commonly referred to as “responsible” or “sustainable” investing, what sets the latter apart is the strategy, formalization and analytical rigor that defines investment decisions. This goes far beyond simply excluding a particular company from a portfolio – it’s a dynamic process of calibrating that portfolio so it meets given criteria in the aggregate, across a range of securities that balance ESG values and potential for returns.

Still, while the data needed to construct ratings and build viable investment products is more readily available than ever, identifying and evaluating the right datasets has proven challenging given the lack of standardized disclosure obligations for companies in addition to inconsistencies between the various providers.

In a recent survey by the Index Industry Association, many U.S. and European asset managers cited difficulties in agreement on standards and a lack of meaningful metrics as a challenge to ESG implementation, with 64% of respondents “concerned about a lack of transparency or insufficient corporate disclosure in relation to firms’ ESG activities.”

“Firms must be much more detailed and precise in categorizing specific initiatives or measures that they value in relation to ESG. This work is laborious and incredibly difficult, as it can be industry-specific and include indicators that are not necessarily measured consistently or with the same rigor as is applied to balance sheets using GAAP,” said Pierre Haren, Co-founder and CEO of Causality Link. “It is necessary for firms to have a method with which to weigh factors and to cap those factors’ contribution to an overall score in order to avoid greenwashing, which would boost a company against measures that are not material to the business.”

“For more than a decade, we have worked to provide material levels of transparency to both the buy and sell sides. ESG is not an amorphous factor, but a representation of the transparency we can provide clients that truly helps them manage their investment risks,” said Andrea Gentilini, CEO of Novus, a portfolio intelligence and data automation platform. “Our allocation clients can access personalized transparency metrics, as opposed to ones rooted in a benchmark metric or measurement. We believe the true value of technology within the rubric of ESG is to help investors have a true view of their portfolios. The ability to control that data and their investments can help them meet their outcome-oriented investment goals.”

Regulatory Pressures Are Heating Up

Amid the enthusiasm and media interest in ESG investing, regulators have begun taking a closer look at the exploding trend, with their specific focus on protecting investors from greenwashing — that is, providing statements that make an investment appear greener than it is. In the EU, the portfolios of fund managers investing in line with ESG considerations are now required to support sustainability claims in addition to meeting certain disclosure standards and rating criteria as part of Sustainable Finance Disclosure Regulation (SFDR).

“The media have largely supported the ESG cause, and this is raising awareness across the board. However, I think that institutions are taking a more urgent stance in the climate change challenge, as demonstrated by Europe’s SFDR, the first such regulation in the financial space,” said Camilla Bossi, Business Development Manager, ESG Solutions at Confluence, a leading global technology solutions provider to the investment management industry. “Europe has led the charge in regulating investment vehicles with UCITS [Undertakings for the Collective Investment in Transferable Securities] regulations, which have been emulated in most of the rest of the world.”

In the U.S., recent actions by the SEC suggest that it may soon take steps to institute similar rules and regulations, most notably the formation of a Climate and ESG Task Force in the Division of Enforcement, dedicated to identifying ESG-related misconduct. But with so much momentum in this area, is the buy side ready to back up its ESG claims if a regulatory crackdown comes to pass?

How Can the Buy Side Meet the Data Demands?

The recent Investor Survey from MackeyRMS and InsiderScore reveals that 67% of funds with fewer than 16 staff said it was difficult to disclose a detailed view of ESG considerations to regulators. Likewise, 66% of respondents said it was difficult to illustrate to investors the impact of ESG considerations on company sustainability practices. MackeyRMS recently released ESG Scorecards to streamline investment selection, monitoring and reporting for ESG-focused portfolios.

“The data shows that should a national regulator initiate an audit, many asset managers would be caught flat-footed,” said Will Keuper, a leading research management software provider. “With this in mind, and as the space continues to grow, it is imperative that firms continue to adapt and grow their compliance capability alongside leveraging solutions that answer the call for increased transparency.”

If asset managers are to satisfy investor demand for sustainable products, experts suggest they might consider revamping their investment processes to include solutions that streamline the creation and analysis of ESG metrics. Incorporating such solutions can help firms get a better sense of what securities should go into each ESG portfolio and more easily discern which factors to prioritize.

“We believe that investors need to be able to easily combine ESG metrics and other risk/performance indicators to streamline the integration of such information into their investment and risk management processes,” said Confluence’s Bossi. “We have embedded in our flagship risk and performance analytical platform, Revolution, a number of ESG metrics leveraging both internal research capabilities and third-party partnerships. We have created a specific ESG add-on that enables users to not only comply with the new regulations in terms of reporting and analytics but to also use the ESG metrics across all the other functionalities of the platform, from scenario analysis to performance contribution. This is what is helping our clients ‘make sense of ESG’ in a way that we believe is also in the spirit of the regulations.”

Solutions of this nature can also help to meet regulatory calls for accurate and comprehensive data. By illustrating how and why each portfolio is constructed, asset managers can ensure their clients are getting the investment vehicles they want while backing up their processes at every step.

“To aid asset managers, Causality Link has designed a set of algorithms that can be tailored by customers and blended with their own structured data dynamically,” added Causality Link’s Haren. “Our AI-driven platform constantly monitors world news in a number of different languages, bringing key information that would have otherwise been overlooked by company disclosures. For instance, we monitor for actions by companies that behave differently than their disclosures suggest, including their subsidiaries and suppliers.”

Greener on the Other Side

There has been a dramatic acceleration of the adoption of ESG investment processes, increasing awareness and sparking dialogue throughout the industry. Money is steadily flowing into ESG funds, and while younger generations have — and may continue to — lead the pack in terms of values-driven approaches, Morningstar data shows that a diverse demographic pool of investors would prefer to see their green making the world greener, with 72% of respondents expressing “at least a moderate interest in sustainable investing.”

With ESG poised to continue its rapid rise, and the regulatory scrutiny that comes with it, it is vital that buy-side firms continue to keep abreast of expectations on all fronts. That means constant news monitoring, engagement with regulators and, where necessary, implementing solutions into their processes that heed calls for data transparency and sustainability.