Below is an excerpt from our 2022 Fintech CMO Survey Report, a deep dive into the opinions and mindsets of a wide range of senior fintech marketers. Over the next few weeks, as firms across the industry set their marketing budgets for 2023, we are highlighting some of the report’s key findings. Download the full report here.

With the industry fighting for shrinking amounts of media oxygen, fintech marketers are seeking fresh program elements and adapting their approach to media relations

For fintech marketers and the firms they serve, adaptation is the name of the game – even if that means rethinking longtime best practices.

The trade media that used to cover this space in so much detail has been in a precipitous decline over the last decade – today, only a handful of outlets survive, and they’ve been forced to narrow their coverage. Fintechs that limit their marketing activities to traditional PR and media relations will find themselves competing with increasingly large firms to reach a shrinking audience.

This has challenged the longstanding assumption that earned media coverage is the ultimate validation of a business. And sure enough, the fintech marketing professionals who responded to our survey indicated a growing appetite for channels that enable them to take their message into their own hands and reach their audience directly.

SEO for Fintech

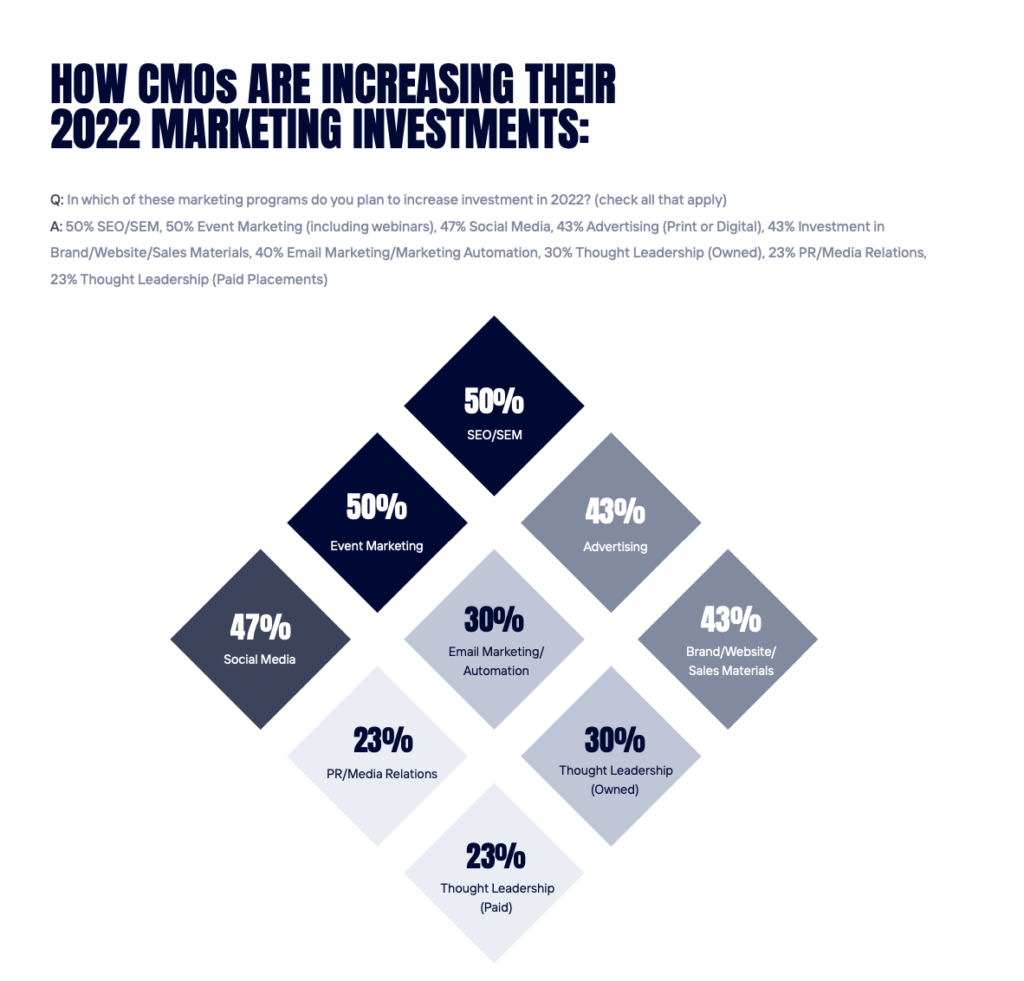

In our survey, 50% of respondents said they intend to increase investment in SEO and SEM in 2022, while 47% of respondents plan to do so for social media and 43% plan to do so for their brand and website. Whether it’s enticing your audience with valuable content, compelling copy or a polished look and feel, each of these tactics results in a direct appeal to prospects without having to go through a third party. Compare those numbers to the 23% of respondents who plan to increase investment in PR and media relations, tied for the lowest of all the program areas.

“Organizations have largely recognized that the best expertise resides within their firms,” said Gary Casagrande, VP of Global Market Strategy at Confluence, a global technology solutions provider to the investment management community. “The flip side to that development is that it puts a lot of pressure on the marketing team to ensure that content pieces don’t feel like advertisements – they must be genuine thought leadership that’s as impartial as possible. I still see the value in articles written by media, but when I’m looking to learn about something, I seek out the best information I can find, regardless of whether it was written by a company or a third party.”

I still see the value in articles written by media, but when I’m looking to learn about something, I seek out the best information I can find, regardless of whether it was written by a company or a third party.”

Gary Casagrande, VP of Global Market Strategy, Confluence

Fintech Content: Take Control

It’s not just the media landscape that is driving this shift. When firms produce their own content, they can track metrics on distribution, engagement and conversions, providing valuable insights into the spend. Media outlets, on the other hand, will likely only share this information if there is a commercial relationship in place, and oftentimes the analytics are rudimentary.

That’s not to say there’s not a role for more traditional methods (more on that later in this report). But it does suggest that fintech marketing professionals have become attuned to the limitations of today’s media landscape and are compensating via their own channels.

“I do see the role of PR in my overall marcomm program diminishing,” said Lorelei Skillman, Chief Marketing and Communications Officer at investment management software and services provider Enfusion. “The amount of resource required to chase after reporters trying to get into a story is sometimes time and money better spent on ongoing direct marketing. Not only can you control your own message – you can reach your target audience with more precision.”

Marketing Strategy: Partnerships Are Key

In addition to these more ownable tactics, many fintech marketers take a more bilateral approach to the media, working with publications to publish content under their company’s own byline. This way, firms can secure some of the validation of an earned media mention while maintaining extensive control over the message. In many ways, this is the best of both worlds.

“When our head of risk and derivatives wrote a whitepaper, before publishing it on our own website, we reached out to Risk.net for interest, and were fortunate that they ended up running it,” said Melinda Joseph, CMO at Sterling Trading Tech, a provider of trading and risk technology. “When we pitch new clients, they often ask about our articles and case studies, and that third-party validation provides a lot of value.”

That attitude jibes with our findings, which suggest that company-written thought leadership and third-party research and whitepapers are the preferred forms of content among fintech marketers. Readers know that the ultimate purpose behind this content is commercial, but they also understand that it’s often the only game in town, and their attitudes are evolving accordingly.

Media coverage will always have value, but in a landscape where earning it is more difficult than ever, fintech marketers must pick up the slack through an integrated, multifaceted marketing and communications program.

Read on for our next blog in our series highlighting the key findings of our 2022 CMO Survey Report.