Below is an excerpt from our 2022 Fintech CMO Survey Report, a deep dive into the opinions and mindsets of a wide range of senior fintech marketers. Over the next few weeks, as firms across the industry set their marketing budgets for 2023, we are highlighting some of the report’s key findings. Download the full report here.

Unprecedented events and the emergence of digital channels have led to a fintech marketing arms race

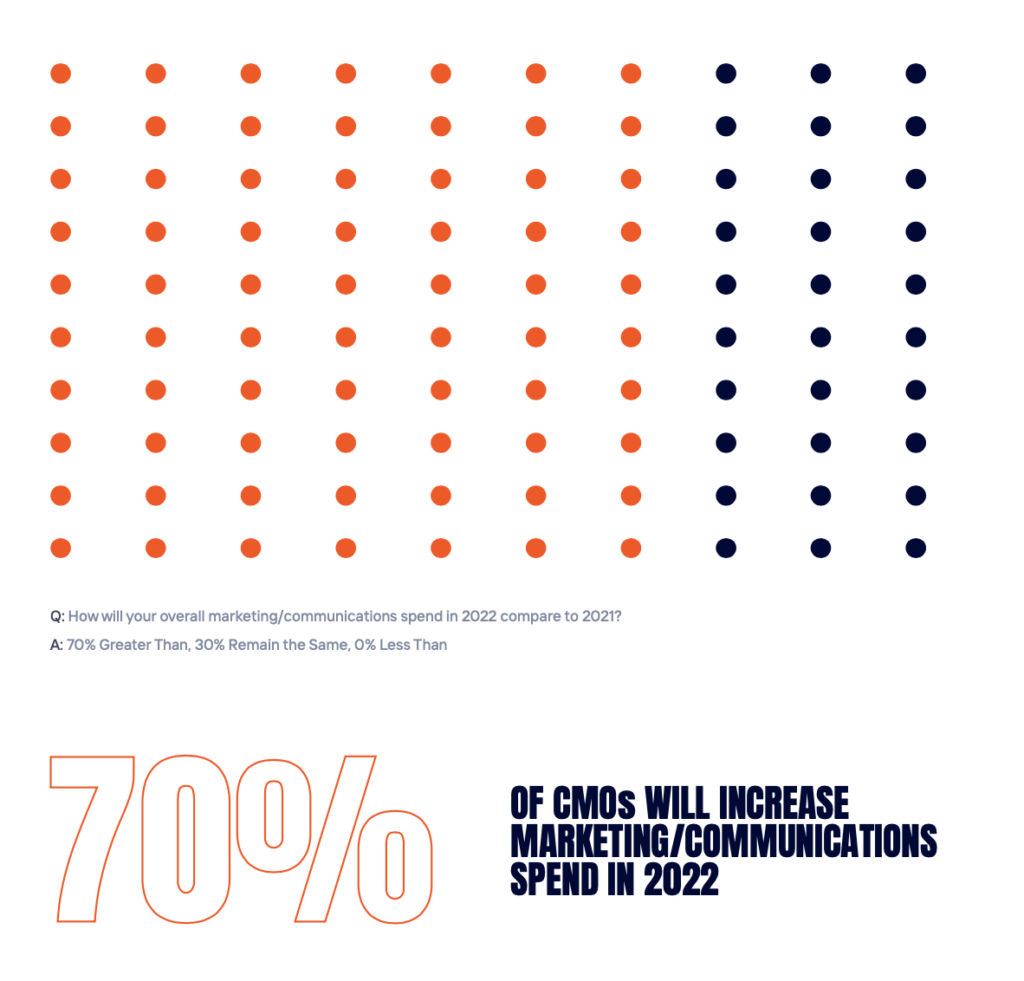

The past two years have been anything but business as usual, bringing about changing priorities that have prompted fintech firms and their marketing departments to reevaluate how they allocate their budgets. As the world creeps back to a sense of normalcy, competition for eyeballs is increasing, and firms are looking to ramp up their investment in marketing and communications (marcomms) programs accordingly. Our survey found that over 70% of CMOs plan to increase their marcomms spend in 2022, focusing on a wide array of program areas from event marketing (both in-person and virtual) to SEO/SEM.

Why Marketing Strategy Is Important

To compete in today’s competitive environment, fintech firms need a good marketing strategy to keep pace with their peers’ willingness to invest in a robust integrated marketing and communications (IMC) program. And while they may decide to lean into one marketing strategy over another, our data demonstrates that senior fintech marketers understand there’s no “silver bullet;” many CMOs are pulling as many levers as they can, holistically expanding their programs to create robust IMC plans that are high-touch and highly effective.

Some of this can be attributed to the COVID-19 pandemic, a true black swan event that upended traditional approaches and forced marketers to level up their creativity and try new things amid the new normal.

“Everyone was stuck at home, so we really had to think critically about how to reach people. I think there was an industry-wide understanding that we all had to get more creative,” said Jessica Darmoni, Senior Manager, Head of Marketing at ErisX, a crypto spot and U.S.-based derivatives exchange and clearinghouse that Cboe Global Markets is in the process of acquiring.

“Marketing really did take a front seat. You had to talk to experts, go outside your comfort zone and innovate to make up for the fact that some of the traditional routes for reaching people were closed off.”

Marketing really did take a front seat. You had to talk to experts, go outside your comfort zone and innovate to make up for the fact that some of the traditional routes for reaching people were closed off.“

Jessica Darmoni, Senior Manager, ErisX

Plan for Digital Marketing

But even before the pandemic, the past decade had seen a dramatic change in the way fintech and capital markets CMOs navigate the marketing landscape. The growing importance of digital marketing channels – and the subsequent displacement of many traditional methods – created the need to maintain a dynamic presence online. In many ways, this was uncharted territory, prompting the need to invest in digital tools and employees with new and more diverse skill sets.

“I’ve been in the space for 18 years. I’ve seen how creating a comprehensive website that is more than an online brochure became a must-have,” said Mireille Adebiyi, CMO and Head of Global Marketing and Communications at Itiviti, Broadridge’s trading technology subsidiary. “When it comes to online marketing, you have to invest accordingly and think more intelligently. Websites and digital content cannot be flat, but must be able to evolve and create a journey of learning and understanding for your clients.”

Fintech Marketing in Flux

The fintech marketing environment is in constant evolution – in recent years, new platforms like Clubhouse and TikTok have made their mark, especially among retail audiences, while analytics around website traffic, pay-per-click (PPC) advertising and search volume have evolved considerably. To successfully spread their message, fintech CMOs must continuously think outside the box, identifying unique opportunities and adopting fresh program elements targeted specifically at their intended audience. Even publications that once defined the traditional media landscape have evolved, creating new and unprecedented opportunities.

“We know our audience intimately, so we have tailored the elements of our program mix to focus on further enhancing brand experience, share of voice and share of mind,” said Lorna Boucher, Chief Marketing Officer & Global Head of Social Responsibility at Instinet, Nomura’s agency brokerage and electronic trading unit. “With this as our goal set, and given the evolution of institutional media, we have been able to connect and partner with outlets to create meaningful and unique content vehicles that are exclusive to us, which would have not been possible previously.”

Read on for the next blog in our series highlighting key findings from our 2022 Fintech CMO Survey Report.