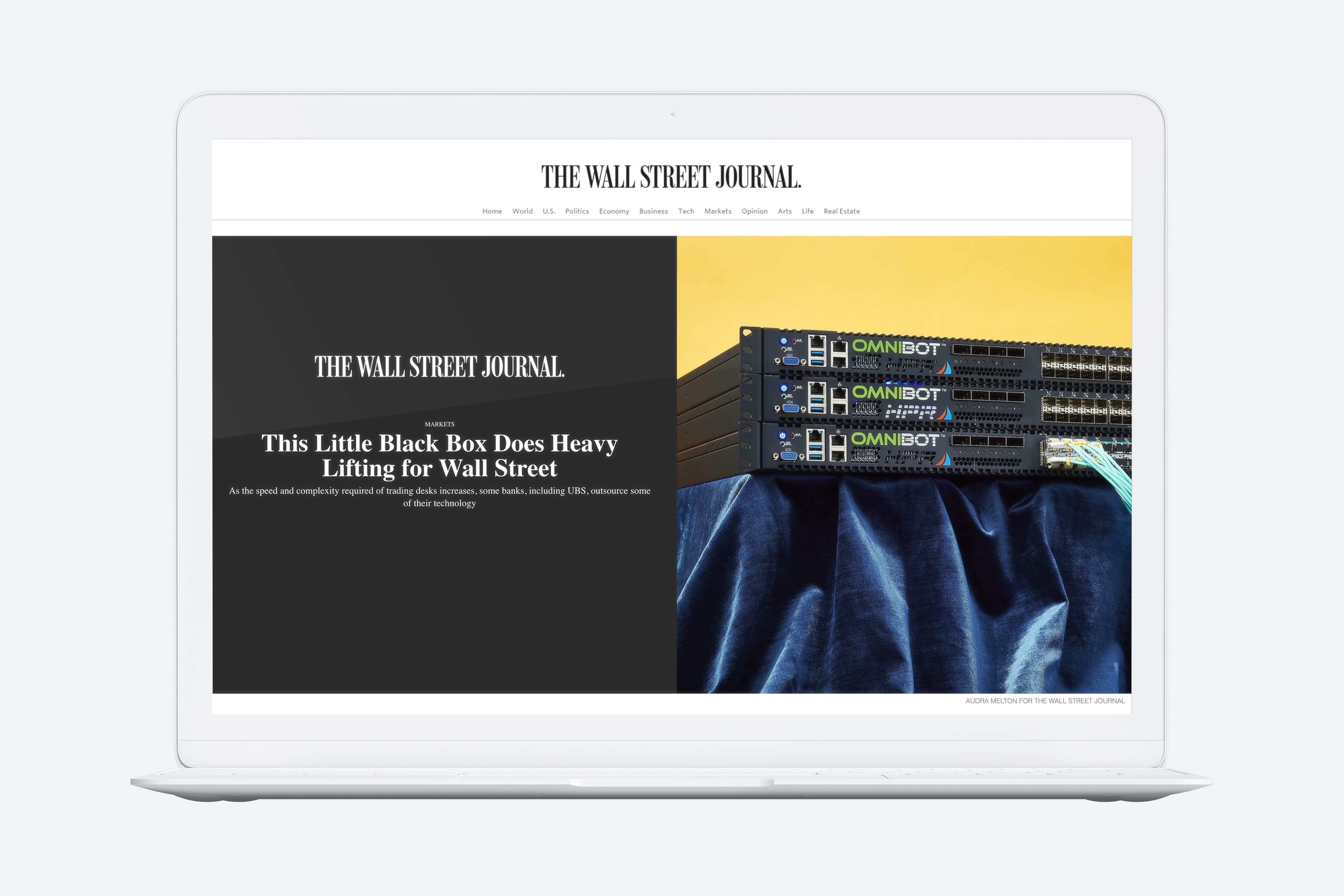

HPR’S “LITTLE BLACK BOX” GETS THE WSJ’S ROYAL TREATMENT

HYANNIS PORT RESEARCH

Bringing a fintech focused on ultra-low-latency pre-trade risk and market access out of obscurity and into a profile in the Wall Street Journal—and beyond

THE CHALLENGE

With trading now occurring at speeds that were unfathomable only a few years ago, the reality is that staggering sums of money can be lost in an instant. Knight Capital represents the most infamous cautionary tale, with a misfiring algo causing it to lose $440 million over the span of minutes on August 1, 2012 and ultimately forcing a fire-sale of the firm to competitor Getco. The incident was a prime example of why the SEC mandated — via Rule 15C3-5 — brokers to have the ability to instantly stop troublesome orders before they reach the market. While this new regulation created significant challenges for the technology platforms of brokers catering to the fastest traders, it also paved the way for the launch of high-performance computing vendor HPR, which married the latest in hardware, networking and cloud technology to create a system that could perform the needed risk checks in mere nanoseconds. But all of this led to a communications challenge for the firm: adoption of a relatively unknown vendor like HPR by the largest banks would be near impossible without sign-off at the highest levels, but how do you create awareness and validation among those notoriously hard-to-reach executives?

THE STRATEGY

The strategy from the beginning for reaching these individuals was to value quality over quantity, creating an air of mystique that many prominent technology firms strive for. HPR should not be ubiquitous, but instead be extremely selective in which media it chose to work with. WatersTechnology, whose approval carried considerable weight among the technologists HPR sought out, was a key target, as was the Wall Street Journal. While we knew the former could bear fruit quickly, the latter would require a concerted strategic effort to pay dividends. That meant not only investing time, but also leveraging the help of HPR’s largest bank clients to validate their story and prove the firm’s bona fides.

EXECUTION

With our targets clear, we began a concerted campaign of good old-fashioned media relations work. For Waters that meant a steady cadence of high-impact story pitches focused on the firm’s product roadmap and approach to technology development as well as a focus on the publication’s highly regarded awards. For the WSJ, the strategy consisted of regular conversations with longtime contacts about HPR’s business, multiple in-person meetings with key editorial leadership and ultimately, the activation of knowledgeable clients to speak on HPR’s behalf.

RESULTS

THIS LITTLE BLACK BOX DOES HEAVY LIFTING FOR WALL STREET

HPR HARNESSES SIMPLICITY TO BUILD THE FUTURE OF CAPITAL MARKETS INFRASTRUCTURE

WELL FARGO’S HEAD OF QUANT STRATEGY EXPLAINS HPR DEPLOYMENT

HPR PREPS MARKET DATA ENTRY WITH DATABOT

WAVELENGTH PODCAST: TONY AMICANGIOLI ON CLOUD, RACE TO ZERO

SIGN UP TO RECEIVE

THE FOREFRONT FINTECH DIGEST

381 Park Avenue South,

Suite 718

New York, NY 10016